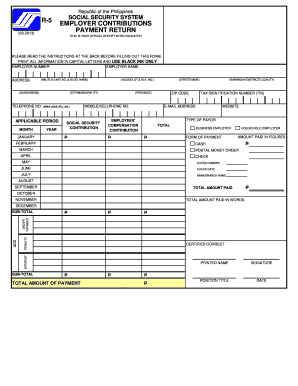

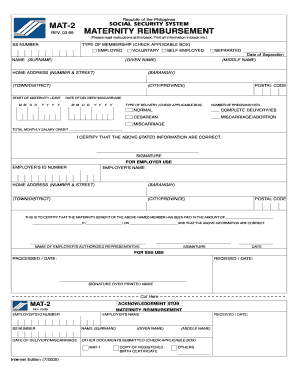

Who needs a Form SSS R-5?

Social Security System (SSS) Employer Contributions Payment Return, Form R-5, must be filed by the employer operating in the Philippines to pay the contributions to their tax account and submit periodic tax returns and employer payroll reports.

What is Form SSS R-5 for?

This is a standard report used by the SSS to account taxes that are paid by the employer for each employee receiving a salary from the employer’s company.

Is Form SSS R-5 accompanied by other forms?

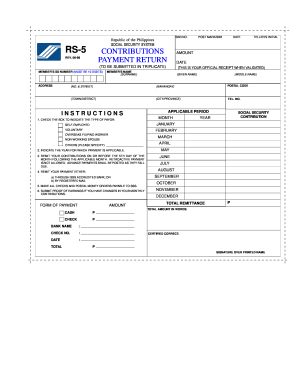

A Special Bank Receipt and Contribution Collection List (Form R-3) must be attached to this SSS R-5 Form before filing.

When is Form SSS R-5 due?

This form and all the necessary attachments should be filed within ten (10) days after the applicable quarter.

How do I fill out Form SSS R-5?

The second page of this fillable SSS R-5 contains an instruction on how to complete the form. Please, check it before filling out a form.

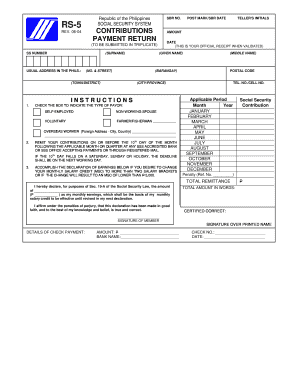

The following items must be filled out in order to complete the form:

- Employer number, name address and other personal details;

- Applicable period for which the return is submitted;

- Type of mayor indication (business employer or household employer); Information on form of payment (cash, postal money order or check);

- Total amount paid;

- Make all checks and postal money orders payable to SSS.

Fill out properly the check details in the “Form of Payment” block. You should print all information in capital letters. Always indicate “N/A” or “Not Applicable”, if the required data is not applicable. Once completed, this form must be signed and dated.

Where do I send Form SSS R-5?

Once completed and signed, this form should be submitted to the nearest SSS office.